When purchasing land, many buyers focus primarily on the price of the property itself. However, one critical element that can significantly impact your overall budget is the closing cost on land. These costs, often overlooked, are essential in the property-buying process. Whether you’re purchasing raw land, seeking a plot for future development, or acquiring land for agricultural purposes, being well-prepared for closing costs ensures you don’t face any surprises when it’s time to finalize the deal. This guide provides a detailed look at what closing costs are, why they matter, and how to effectively manage them.

What Are Closing Cost on Land?

Closing cost on land refer to a range of fees and expenses associated with completing a land transaction. These are the costs that need to be covered during the settlement or closing process, ensuring the transfer of ownership is legally binding and all necessary documentation is filed. Unlike the purchase price, which is typically agreed upon in advance and can be negotiated, closing costs are often unexpected and can vary based on the property’s location, type, and other external factors. These costs must be paid either before or on the day of closing for the transaction to be legally complete.

While the price of the land itself may be the most visible cost, closing costs contribute to the overall financial outlay and must be factored into your budget. Without accounting for these additional expenses, buyers may find themselves financially strained, especially if unexpected costs arise during the closing process.

Why Closing Costs on Land Matter

The importance of closing costs on land cannot be overstated. These fees, though sometimes seen as small or insignificant, can add up quickly and significantly alter the total amount of money you need to close the deal. The total amount of these costs can vary widely depending on several factors, including the land’s location, the type of transaction, and any specific requirements related to the property.

The costs involved in closing a land deal can impact your immediate financial planning, particularly if you’re not prepared for them. They can also affect your long-term budgeting if the total costs increase beyond your initial estimates. If you’re financing the land purchase, understanding these costs upfront helps ensure you’re prepared for the final payment, avoiding any last-minute delays or complications.

Common Closing Costs in Land Transactions

When you enter into a land transaction, you’ll likely encounter a variety of fees that make up your closing costs on land. These costs can be quite diverse depending on the property type, its location, and the legal requirements for the transaction. Below are some of the most common types of fees that buyers can expect:

Title Insurance

Title insurance is often one of the most important expenses in any real estate transaction. It protects both the buyer and the lender from financial loss due to defects in the property title. These defects might include issues such as outstanding liens, unresolved ownership disputes, or hidden claims against the land. Without title insurance, buyers could face significant financial and legal complications if someone later contests the ownership of the property.

Typically, the cost of title insurance is calculated based on the price of the land. In many transactions, the buyer covers the cost of title insurance. However, this can sometimes be negotiated, with the seller agreeing to cover some or all of the title insurance fees. Even in cases where title insurance is not required by law, it is still strongly recommended to safeguard the transaction.

Recording Fees

Recording fees are paid to local government offices for the purpose of officially recording the deed and other documents related to the transaction. These fees ensure that the transfer of ownership is documented in the public records, making it legally binding and accessible to the public. Without this step, the land ownership may not be recognized by authorities or legal entities.

These fees are typically calculated based on the number of pages of the deed or the property’s value. The amount of the fee can vary significantly depending on the county or jurisdiction in which the property is located. Therefore, it’s important to check with the local office where the deed will be recorded to determine the exact cost.

Transfer Taxes

Transfer taxes are taxes levied by state or local governments on the sale or transfer of property. These taxes are typically calculated as a percentage of the sale price, and they can vary depending on the location of the property. In some jurisdictions, the seller pays the transfer tax, while in others, it’s the buyer’s responsibility. Sometimes, the parties may agree to split the tax or have one cover the full cost.

It’s important to research the transfer tax rates in the specific county or state where you’re buying the land. These taxes can represent a significant cost in the transaction, so understanding your liability upfront will help you better prepare for closing day.

Survey Costs

When purchasing land, especially if the property is large or there is any uncertainty about its boundaries, a survey is often required. A land survey helps establish the precise boundaries of the property, ensuring that there are no disputes about property lines after the transaction is complete. Surveys can also uncover potential issues such as encroachments or zoning violations that could affect the land’s use.

The cost of a land survey depends on the size, location, and complexity of the parcel. Larger properties or those in more remote areas may cost more to survey, while smaller or more easily accessible plots tend to be less expensive. In some cases, a survey may be required by the lender or local government, especially if the land is being developed.

Attorney Fees

In some cases, buyers or sellers may hire a real estate attorney to assist with the closing process. Although it is not always necessary, a real estate lawyer can help with reviewing contracts, resolving title issues, and ensuring that the transaction complies with local laws. In areas where land transactions are more complex or if there are legal disputes regarding the land, an attorney can provide valuable guidance.

Attorney fees can vary widely depending on the region and the attorney’s experience. In some cases, you may need to pay an hourly rate for their services, while others may offer flat fees for handling specific tasks. Consulting with an attorney can help protect your interests and avoid potential pitfalls during the transaction.

Escrow Fees

An escrow service is often used during land transactions to ensure that funds and documents are securely held until all parties have met their obligations. The escrow agent acts as a neutral third party, making sure that the buyer receives clear title to the land, and the seller receives the agreed-upon funds. Escrow fees are typically split between the buyer and seller, but this can vary based on the specifics of the transaction.

The cost of escrow services can depend on the complexity of the deal and the escrow company used. Escrow fees may be a flat fee or calculated as a percentage of the sale price. It is important to clarify the amount and who will cover the cost during negotiations.

Inspection Fees

Depending on the type of land you’re purchasing, you may need to pay for inspections to verify that the land is suitable for its intended use. For example, if you’re purchasing land for development, you might need environmental assessments, soil tests, or evaluations of the land’s infrastructure and zoning status.

Inspection fees can vary widely depending on the scope of the inspections. Standard land inspections can range from a few hundred to a few thousand dollars, depending on the complexity of the property. It’s essential to factor in these costs when planning your budget for the purchase.

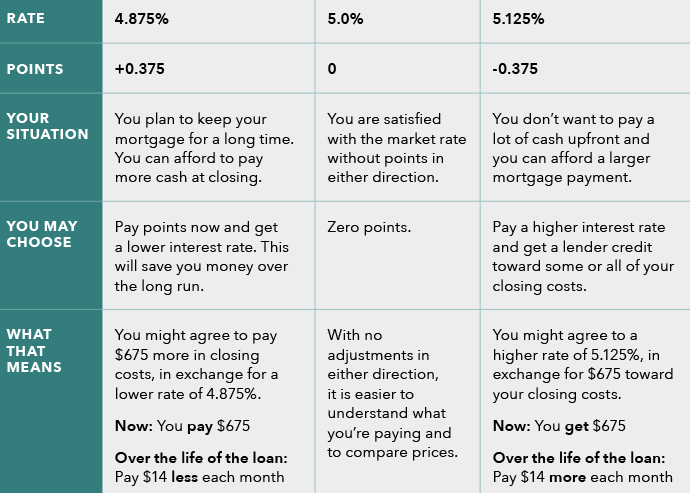

Loan-Related Fees

If you’re financing the land purchase with a mortgage, you may encounter additional fees related to securing the loan. These fees could include application fees, loan origination fees, underwriting fees, and other charges. The cost of financing can vary depending on the lender and the type of loan you’re taking out.

In some cases, these costs can be rolled into the loan, but they can still impact your total financial commitment. It’s important to understand all loan-related costs early in the process, as these can increase the total cost of the land purchase. If you’re working with a lender, they will provide you with a detailed breakdown of all associated fees.

How to Estimate Closing Cost on Land

Estimating closing cost on land is a crucial part of preparing for your purchase. While every land transaction is unique, there are general guidelines that can help you gauge the costs involved. Let’s explore a few of the most common methods for estimating these costs:

Percentage-Based Estimation

A common rule of thumb is that closing cost on land typically range from 2% to 5% of the property’s purchase price. For example, if you are buying a piece of land for $100,000, your closing costs may be anywhere between $2,000 and $5,000. This range provides a rough estimate, but keep in mind that various factors—such as the location of the land and the specific costs associated with your transaction—can cause the actual figure to fall outside of this range.

While this estimate is a helpful starting point, it’s important to obtain quotes from all service providers involved in the closing process to get a more accurate prediction of your final costs.

Land Value and Location

The value of the land and its location can significantly affect closing costs on land. Properties in urban areas tend to have higher fees due to more extensive legal and governmental requirements. For example, urban properties may require additional zoning reviews, inspections, and surveys to confirm the property’s suitability for construction or development.

On the other hand, rural properties may have lower fees since there are fewer regulations and requirements involved. However, remote properties may require additional services such as long-distance surveys or special assessments, which could increase your overall closing costs.

Additional Fees

Some unique properties may require additional services or inspections that contribute to higher closing costs on land. For instance, if the land is subject to environmental concerns or contains hazardous materials, you may need to invest in specialized environmental inspections, which could add to your closing expenses. Similarly, if the property has unresolved legal or title issues, you may incur additional costs for legal assistance or title searches.

By researching the specific requirements for the land you’re purchasing, you can better anticipate any additional fees that may apply and plan your budget accordingly.

Factors That Can Affect Closing Cost on Land

Several factors can influence the total amount of closing costs on land you’ll incur. Below are some of the key factors to consider when planning your land purchase:

Size and Type of Land

Larger or more complex land parcels can lead to higher closing costs on land. For example, agricultural or commercial properties often have more complicated legal and zoning considerations than residential plots. Additionally, the larger the land, the more likely it is that a survey or other inspections will be required, which can drive up costs.

Location

The state and county where the land is located will significantly impact closing cost on land. Different states have different property tax laws, recording fees, and transfer taxes, all of which can affect the overall cost of the transaction. In some areas, land may be subject to higher taxes or fees due to local regulations, so it’s crucial to research the specific rules in your area.

Financing vs. Cash Purchase

When purchasing land, how you choose to pay can greatly affect your closing cost on land. A cash purchase is generally less expensive in terms of closing costs since there are no lender-related fees. On the other hand, if you’re financing the purchase, there will be additional costs associated with loan origination, application fees, and potentially higher title insurance costs.

Title and Lien Issues

If the land has any title defects or liens against it, you’ll need to pay for the costs associated with clearing these issues before closing. This could include legal fees, title searches, and payments to settle outstanding debts on the property. It’s critical to conduct a thorough title search early in the process to identify any potential issues and avoid unexpected costs at the closing table.

Who Pays Closing Costs on Land?

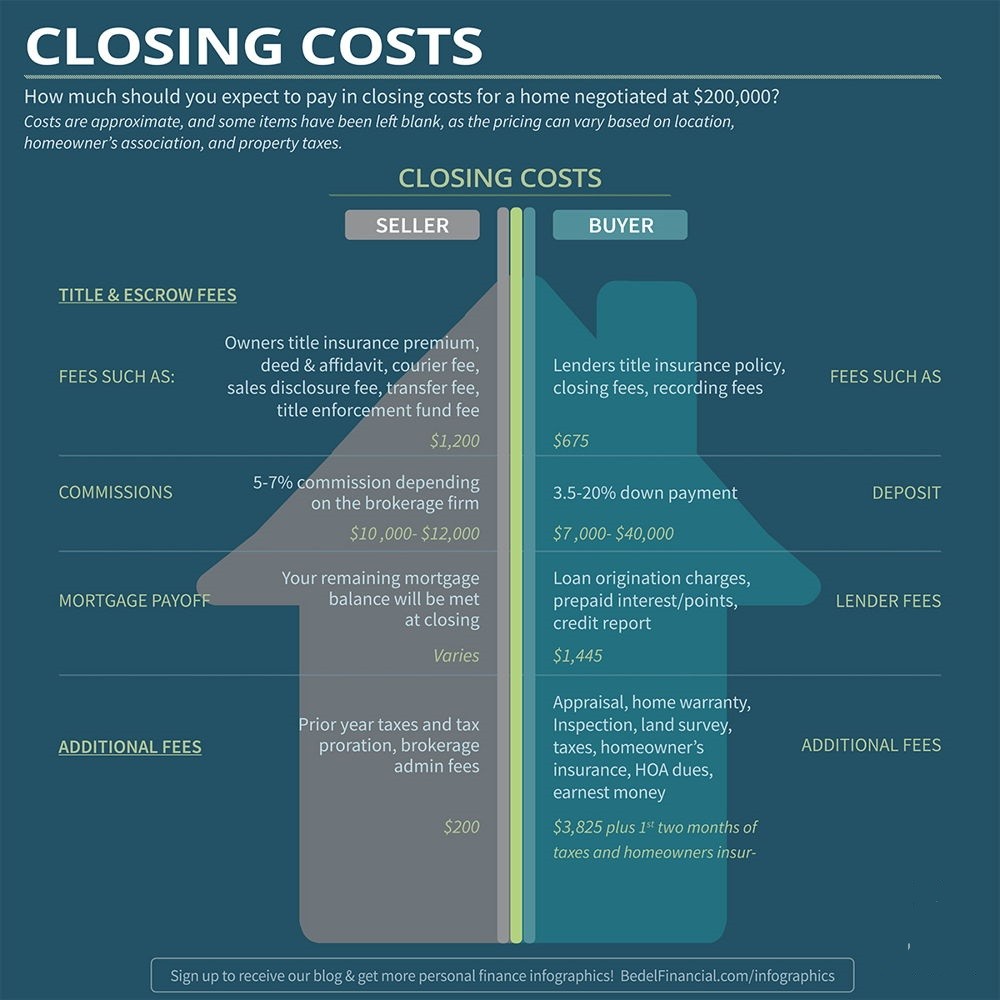

When buying land, it’s essential to clarify who is responsible for covering each type of closing cost on land. Typically, both the buyer and the seller share responsibility for various costs, though this can vary depending on the specifics of the deal.

Buyer’s Responsibility

The buyer is usually responsible for paying for services such as title searches, title insurance, land surveys, and any loan-related fees if financing the purchase. The buyer also typically covers the escrow fees and may pay for certain inspections related to the property.

Seller’s Responsibility

The seller generally pays for the real estate agent’s commission and may also cover certain legal fees. In some cases, the seller may be responsible for transferring the title or clearing any outstanding liens or debts on the property. However, many of these responsibilities are negotiable and can be part of the overall deal structure.

Negotiations

In some cases, buyers and sellers can negotiate who will pay for specific closing costs. For instance, in a buyer’s market or when the seller is motivated to close the sale quickly, the seller may agree to cover some of the buyer’s closing costs. Conversely, if the property is in high demand, the buyer may need to cover more of the costs.

How to Reduce Closing Cost on Land

Closing cost on land can be a significant part of the overall expense when buying property, but there are ways to manage and even reduce these costs. Here are some strategies that can help minimize the financial burden:

Negotiate with the Seller

One of the most effective ways to reduce closing cost on land is to negotiate with the seller. In some cases, buyers may be able to persuade the seller to cover some of the costs, especially if the seller is motivated to complete the transaction quickly. For instance, you can ask the seller to pay for title insurance, recording fees, or a portion of the escrow fees. In a buyer’s market, where there’s more supply than demand, the seller might be more willing to agree to such terms.

It’s essential to approach these negotiations tactfully. Sellers may be more inclined to negotiate if they are aware that the transaction will go smoothly and without delays. Additionally, offering a reasonable purchase price and a quick closing can make the seller more likely to consider your requests.

Shop Around for Services

Many of the closing cost on land are related to services provided by third parties, such as title companies, surveyors, and attorneys. By shopping around and comparing prices, you can find the best deals for these services. For instance, different title companies may offer varying rates for title searches and title insurance. Similarly, surveyors may charge different fees depending on their level of expertise or the complexity of the land survey.

Additionally, some states and localities have multiple providers offering the same service, such as title insurance or escrow management. Shopping around for the best rates and service providers can help reduce overall closing costs. Be sure to read reviews and check references to ensure that you’re getting quality service at a fair price.

Consider Seller Financing

In cases where traditional financing is not available or if you want to simplify the transaction process, consider opting for seller financing. With seller financing, the seller acts as the lender, and the buyer makes payments directly to them instead of through a bank or financial institution. This option can reduce closing cost on land, as it eliminates many of the fees associated with traditional lending, such as loan origination fees, underwriting costs, and other mortgage-related expenses.

However, it’s essential to understand that seller financing comes with its own set of risks and complexities. It’s important to carefully review the terms of the financing agreement, ensure the interest rates and repayment terms are reasonable, and consult a real estate attorney to ensure that everything is structured correctly.

Review and Eliminate Unnecessary Fees

When reviewing your closing statement or settlement documents, take the time to carefully assess all fees and charges. Sometimes, fees may be added that are not necessary for the completion of the transaction. For example, you may find that you’re being charged for an inspection or service that you don’t need or that duplicates another service you’ve already arranged.

If you spot any unnecessary fees, speak with the relevant parties involved (e.g., the escrow company, title company, or real estate agent) to determine if they can be removed or reduced. It’s crucial to be proactive in identifying and eliminating unnecessary expenses to help lower your closing costs on land.

Closing Cost on Land vs. Maintenance Costs

While closing costs on land are a one-time expense that buyers incur at the beginning of the transaction, maintenance costs are ongoing expenses that are associated with owning the land after the deal has closed. It’s important to differentiate between these two types of expenses when planning your land purchase.

Upfront vs. Ongoing Expenses

Upfront closing costs on land can be substantial, but they represent a one-time outlay of funds required to complete the transaction. Once the deal is closed, you’ll no longer need to worry about these costs unless you decide to sell the land or undertake a significant development project. In contrast, maintenance costs are recurring expenses that occur throughout the period of land ownership. These can include property taxes, insurance, land maintenance, and other costs associated with preserving the land.

When budgeting for land ownership, it’s crucial to plan for both types of costs. Buyers often focus heavily on closing cost on land, but it’s also essential to account for long-term maintenance and operational expenses. For example, if you’re buying agricultural land, you’ll need to budget for irrigation, equipment, and crop management costs. Similarly, if you’re purchasing land for development, you may face zoning fees, permits, and infrastructure development costs in the future.

Budgeting for Land Ownership

Successfully managing both closing cost on land and ongoing maintenance costs is essential for ensuring that land ownership remains financially feasible over time. Consider these additional steps when budgeting for land ownership:

- Estimate property taxes: Property taxes can vary based on the location and value of the land. Be sure to research the local tax rates and estimate the amount you will owe each year.

- Plan for future development: If you plan to develop the land in the future, budget for costs related to building permits, infrastructure development, and legal fees.

- Insurance: Depending on the type of land you own, you may need insurance to protect against natural disasters, liability, or other risks.

- Land maintenance: If your land requires regular upkeep, such as mowing, fencing, or environmental stewardship, be sure to factor in these ongoing expenses.

While closing costs on land may only happen once, maintaining your land involves long-term financial planning. By accounting for both upfront and ongoing expenses, you can ensure that you’re fully prepared for the costs of land ownership.

Conclusion: Why Paying Attention to Closing Costs Is Essential

When purchasing land, understanding and properly budgeting for closing costs on land is an essential step in ensuring a smooth transaction. These costs, while often overlooked, can significantly impact the final price of your land purchase. By carefully evaluating the fees involved and considering ways to reduce them, you can minimize your financial burden and make informed decisions throughout the buying process.

The key to a successful land purchase is thorough research and preparation. From shopping around for service providers to negotiating with the seller, there are numerous ways to manage and lower closing costs. Additionally, factoring in ongoing maintenance costs is crucial for long-term financial planning and ensuring that land ownership remains sustainable.

Before proceeding with your land purchase, consult with professionals such as real estate agents, attorneys, and title companies to ensure you have all the information you need to make sound decisions. By understanding both closing costs on land and ongoing maintenance expenses, you can navigate the land-buying process confidently and without unexpected financial strain.

Frequently Asked Questions (FAQ)

What’s the average cost for closing on land?

The average closing costs on land typically range from 2% to 5% of the land’s purchase price. However, this can vary depending on location, property type, and specific transaction details.

Are closing costs different for land than for houses?

Yes, closing costs on land tend to be lower than those associated with purchasing a house. However, they can still vary depending on the land’s value, location, and any specific requirements for the transaction.

Can closing costs be financed into the loan?

In some cases, closing costs can be rolled into the loan if you are financing the land purchase. However, this depends on the lender’s policies and the type of loan you’re securing.

What happens if I can’t afford the closing costs?

If you’re unable to afford the closing costs on land, you may need to delay the purchase until you can secure the necessary funds. Alternatively, you can negotiate with the seller to cover some of the costs, or you could seek other financing options to cover the expenses.

By carefully planning and considering your financing options, you can reduce the impact of closing cost on land and ensure that your land purchase proceeds smoothly.