Investing in real estate has long been one of the most popular and reliable ways to build wealth. One of the most promising and rapidly growing opportunities within the real estate sector is the Build-to-Rent (BTR) market. If you’re considering how to invest in Build-to-Rent, this guide will help you explore all the facets of this unique investment strategy. We’ll dive deep into what makes Build-to-Rent such a compelling option, how you can get involved, and what factors to consider before diving in.

By the end of this article, you will have a thorough understanding of how to invest in Build-to-Rent properties and what makes them such an attractive long-term investment opportunity in today’s real estate market.

What Is Build-to-Rent?

Build-to-Rent (BTR) refers to properties that are specifically constructed for the purpose of being rented out, rather than being sold to individual buyers. These developments are built with the tenant in mind, incorporating high-quality materials, modern designs, and an array of amenities that make them particularly appealing to renters. The concept of Build-to-Rent focuses entirely on meeting the growing demand for rental properties, particularly in urban areas where rental demand is consistently strong.

The Difference Between Build-to-Rent and Traditional Buy-to-Let

A key distinction between Build-to-Rent and traditional buy-to-let properties is that BTR developments are constructed with the explicit goal of renting out all units. In contrast, traditional buy-to-let properties typically involve purchasing an existing home or apartment with the intent of leasing it to tenants. Traditional buy-to-let investors often buy properties in areas where they believe rental demand will be high, but they may also deal with a range of maintenance and management challenges since the properties were not built with renters’ needs in mind.

In the case of Build-to-Rent, the developers plan and build the entire property as a long-term rental asset. These developments typically feature amenities and designs that appeal directly to renters, such as spacious layouts, modern appliances, and shared spaces like gyms, lounges, or coworking areas. The focus on long-term rentals as opposed to short-term ownership or sale allows BTR properties to cater specifically to the needs of renters, offering a higher standard of living and a more professional level of management.

The Role of Developers, Investors, and Property Management Companies

The Build-to-Rent sector involves multiple key players, including developers, investors, and property management companies. Developers are responsible for the planning, construction, and initial marketing of the property. Investors contribute capital to fund these projects, with the expectation of receiving returns through rental income and potential capital appreciation over time. Property management companies handle the day-to-day operations of BTR properties, ensuring that everything runs smoothly for both tenants and investors. They deal with lease agreements, maintenance, rent collection, and more, creating a hassle-free experience for both parties.

Why Invest in Build-to-Rent?

Investing in Build-to-Rent offers a range of benefits, from consistent cash flow to long-term capital appreciation. Here are some of the reasons why more and more investors are turning to Build-to-Rent properties.

Consistent Cash Flow

One of the most appealing aspects of investing in Build-to-Rent properties is the potential for steady, reliable cash flow. These properties are designed to cater to renters who seek long-term living arrangements, providing landlords with a continuous stream of rental income. With BTR properties, vacancy rates tend to be lower compared to traditional rental properties, as tenants are typically on longer leases (12 to 24 months). This reduces the risk of income volatility due to tenant turnover, making Build-to-Rent an attractive option for investors looking for stable returns.

Moreover, the growing trend of people renting rather than owning homes—especially in urban areas where housing prices are rising—supports the sustainability of consistent rental income. With a strong tenant base and professional property management, BTR investments tend to offer predictable returns.

High Demand for Rental Housing

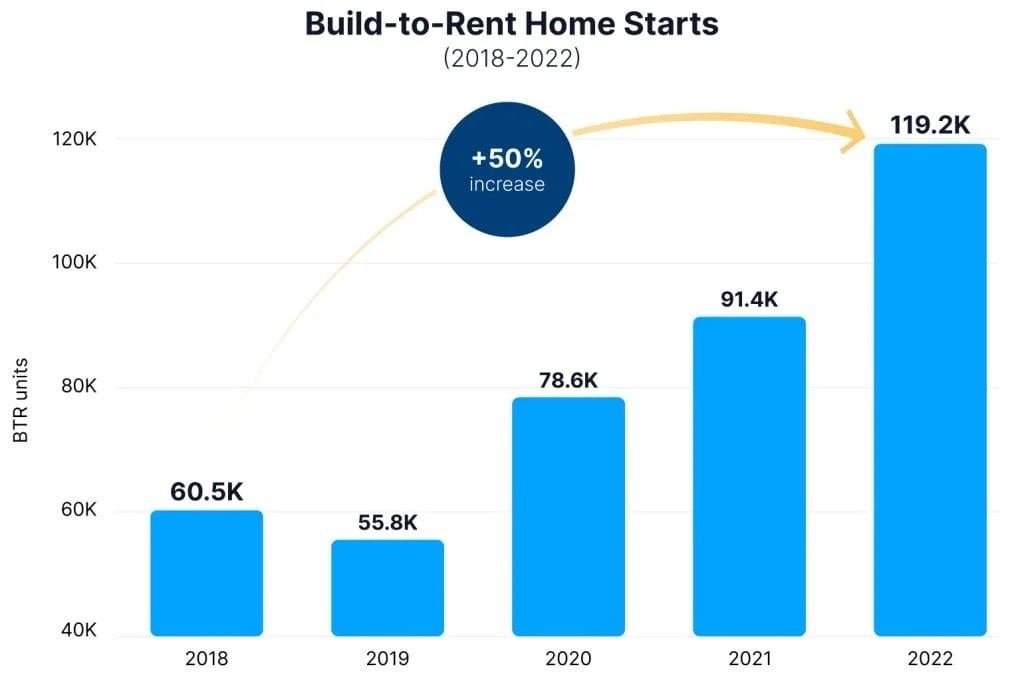

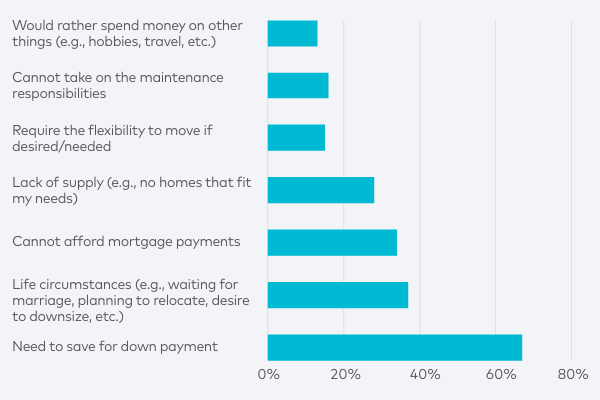

The demand for rental properties, particularly in cities and urban areas, has been on the rise. Millennials, young professionals, and even baby boomers are increasingly turning to rental housing for flexibility and convenience. As homeownership becomes less attainable for many due to rising prices, renting has become a more common living arrangement.

This growing demand for rental housing presents a unique opportunity for investors in the Build-to-Rent sector. Properties built specifically for the rental market, such as those in the Build-to-Rent sector, are positioned well to meet the needs of this growing rental population. Whether it’s a single-family home or a larger apartment complex, Build-to-Rent properties cater directly to this increasing rental demand.

Stability and Resilience in Economic Downturns

Another benefit of investing in Build-to-Rent is the sector’s relative stability during economic downturns. Real estate, as a tangible asset, is often considered a safe haven in times of economic uncertainty. While property values may fluctuate with market conditions, the need for housing remains steady. Even in tough economic times, people will still need a place to live, and many will continue to rent instead of purchasing homes.

The Build-to-Rent model, with its focus on long-term rentals, tends to be more resilient in downturns compared to traditional buy-to-let investments. By offering professionally managed rental housing that caters to the growing population of renters, BTR investments tend to provide stability in both rental income and overall property value.

Long-Term Capital Appreciation

Real estate generally appreciates in value over time, and Build-to-Rent properties are no exception. As an investor in this sector, you stand to benefit from both rental income and the potential for capital gains as property values increase. Over the long term, BTR properties can become highly valuable assets, providing both income and capital growth opportunities.

Location plays a significant role in this potential for appreciation. Investing in properties situated in areas with high rental demand—such as proximity to universities, business districts, or transportation hubs—can increase the likelihood of strong capital appreciation over time.

Attractive to Institutional Investors

The Build-to-Rent sector has been drawing increasing attention from large institutional investors, such as pension funds, Real Estate Investment Trusts (REITs), and private equity firms. These entities are attracted to Build-to-Rent properties because of the stable cash flow, potential for long-term growth, and the relative security of real estate investments.

Institutional investors often have substantial capital to deploy in large-scale Build-to-Rent developments, which can lead to greater liquidity in the market and more opportunities for individual investors to tap into these large-scale projects. Additionally, the growing institutional interest in Build-to-Rent adds credibility and stability to the sector, making it an even more attractive investment class.

Key Features of Build-to-Rent Properties

As you consider how to invest in Build-to-Rent, it’s essential to understand the unique characteristics of these properties that make them such a strong investment opportunity. Below are some key features that define Build-to-Rent properties.

High-Quality, Purpose-Built Units

The primary defining characteristic of Build-to-Rent properties is their design and construction. These units are purpose-built with the renter in mind. This means they are designed to offer long-term comfort, functionality, and modernity. Properties are often built with durable, high-quality materials and include amenities tailored to the needs of renters, such as energy-efficient appliances, spacious layouts, and contemporary design features.

Unlike traditional buy-to-let properties, where individual investors might purchase pre-existing homes or apartments, Build-to-Rent properties are constructed with renters as the target demographic. This leads to better quality, more desirable living spaces, and ultimately higher occupancy rates and rental yields.

Amenities and Facilities

Another important feature of Build-to-Rent developments is the wide range of amenities and facilities they offer. These amenities can be a significant draw for potential tenants, as they enhance the living experience. Common areas might include gyms, co-working spaces, community lounges, rooftop terraces, or even on-site cafes and retail outlets.

The goal of these amenities is to make the properties more attractive to potential tenants and to foster a sense of community among renters. For investors, these added features can justify higher rental prices and help ensure tenants remain happy and committed to long-term leases.

Professional Property Management

Managing a rental property requires careful attention to detail, and in the Build-to-Rent model, this task is typically handled by professional property management firms. These companies specialize in managing large-scale rental properties, offering services such as rent collection, tenant relations, maintenance, and security.

For investors, this professional management is a key benefit, as it removes the day-to-day responsibilities of being a landlord. Property management companies ensure the property remains well-maintained and that tenants have a positive living experience. This not only enhances tenant retention but also ensures the property remains a profitable investment.

Long-Term Leasing

The long-term lease model is another defining feature of Build-to-Rent properties. Most BTR properties offer leases that range from 12 to 24 months, which helps provide a steady income stream for investors. These leases are attractive to tenants who are seeking stability and security in their housing situation.

In contrast to traditional rental properties, where leases may be shorter or subject to more frequent renewals, long-term leasing in Build-to-Rent properties reduces turnover rates and ensures consistent cash flow for the investor. This stability makes BTR properties appealing to those seeking less risk and more predictable returns.

Focus on Tenant Experience

Developers and property managers in the Build-to-Rent sector place a strong emphasis on tenant satisfaction. The goal is to create a community of happy, long-term tenants who are satisfied with the quality of their living environment. This focus on tenant experience often includes offering responsive customer service, maintaining the property to high standards, and creating a welcoming and community-oriented atmosphere.

By focusing on tenant experience, Build-to-Rent developers and investors can maintain high occupancy rates and secure reliable, long-term rental income. Satisfied tenants are also more likely to renew their leases, reducing turnover and vacancy rates.

Types of Build-to-Rent Investments

When exploring how to invest in Build-to-Rent, you will find a variety of investment types. Depending on your investment goals and risk tolerance, you may choose one type of BTR investment over another. Below are the main types of Build-to-Rent properties you can consider:

Single-Family Build-to-Rent

Single-family Build-to-Rent properties are standalone homes designed specifically for rental. These properties are often attractive to tenants who want more space, privacy, and a suburban lifestyle compared to the typical apartment complex. Single-family BTR properties may be located in residential neighborhoods or in suburban areas, appealing to families or individuals looking for more room to live.

For investors, single-family Build-to-Rent properties can provide stable rental income and lower tenant turnover compared to multi-family units, as these homes tend to attract longer-term tenants. Additionally, they often require less management than multi-family developments, making them an ideal option for investors looking for a more hands-off approach.

Multi-Family Build-to-Rent

Multi-family Build-to-Rent properties, on the other hand, consist of larger residential complexes with multiple rental units. These developments are typically located in urban areas and cater to a diverse tenant base, including young professionals, students, and retirees. Multi-family BTR properties often feature a variety of amenities, including fitness centers, lounges, and communal areas that foster a sense of community among residents.

For investors, multi-family Build-to-Rent properties tend to offer higher rental yields due to the larger number of units and greater rental demand in urban locations. However, they also require more management and have higher upfront capital requirements.

Mixed-Use Developments

Mixed-use Build-to-Rent developments combine residential units with commercial spaces, such as retail stores, restaurants, or office spaces. These developments are often located in prime urban locations and offer investors the benefit of diversified income streams. By incorporating commercial properties alongside residential rentals, mixed-use BTR developments can provide additional rental income and reduce dependency on residential tenants alone.

Mixed-use developments also provide a more dynamic living experience for tenants, as they can live, work, and shop all in one location. This is particularly attractive to young professionals and those living in busy urban centers who value convenience and easy access to amenities.

Urban vs. Suburban BTR

Another important distinction in Build-to-Rent investment is the choice between urban and suburban locations. Urban BTR developments are typically located in city centers, close to transportation hubs, employment districts, and entertainment options. These locations tend to have higher rental demand, but they can also come with higher property prices and more competition.

Suburban BTR properties, in contrast, may offer lower property prices and the opportunity to cater to families or individuals looking for more space at a lower cost. Suburban developments may be located near schools, parks, and other family-oriented amenities, appealing to a different demographic than urban BTR properties.

Urban areas offer the appeal of accessibility and convenience, making them attractive to a younger, mobile tenant base, such as professionals or students. These locations often have higher demand, with renters willing to pay a premium for proximity to work, transportation, and entertainment options. However, the price of land and construction costs in urban areas can be higher, which may result in higher upfront investment requirements and potentially lower rental yields depending on the location.

Suburban Build-to-Rent developments, on the other hand, offer investors the opportunity to capitalize on a growing trend of people seeking more space and affordability. With many individuals and families relocating to suburban areas for more affordable living, particularly post-pandemic, these properties are increasingly in demand. The cost of land is often lower, and the development process may be less expensive, potentially resulting in higher margins for investors.

Both urban and suburban BTR investments have their unique advantages and risks. Urban developments offer greater rental yield potential but come with higher costs and competition, while suburban properties may offer lower investment costs and higher yield potential with a focus on long-term tenant retention.

How to Invest in Build-to-Rent

There are several ways to approach investing in Build-to-Rent properties, depending on your budget, preferences, and risk appetite. Whether you’re looking for a more active role in property management or a hands-off approach, you can find an investment strategy that suits your needs. Below are some of the most common ways to invest in Build-to-Rent properties:

Direct Investment in BTR Projects

The most straightforward way to invest in Build-to-Rent is by directly purchasing a property or unit in a Build-to-Rent development. This can involve buying an individual unit or an entire property, either from a developer or in the secondary market. Investors who choose this route typically manage the property themselves or hire a property management company to handle the day-to-day operations.

Direct investment in BTR projects provides the opportunity for investors to have full control over their assets and enjoy the benefits of rental income and potential property appreciation. However, this method often requires a significant capital outlay, as well as experience in managing rental properties.

Investing Through REITs (Real Estate Investment Trusts)

For investors who prefer a more passive approach to Build-to-Rent, Real Estate Investment Trusts (REITs) provide an excellent option. A REIT is a company that owns, operates, or finances real estate properties, including those within the Build-to-Rent sector. By purchasing shares in a REIT, investors can gain exposure to a diversified portfolio of BTR properties without the need to directly manage any real estate.

REITs typically pay out a portion of their rental income to shareholders in the form of dividends, providing a steady stream of passive income. For those interested in how to invest in Build-to-Rent properties without taking on the responsibilities of direct ownership, REITs offer an attractive alternative with lower capital requirements.

Crowdfunding Platforms

Real estate crowdfunding has emerged as a popular option for smaller investors looking to enter the Build-to-Rent market. Crowdfunding platforms allow multiple investors to pool their capital together and invest in large-scale BTR projects. Through these platforms, investors can participate in the development and ownership of Build-to-Rent properties with smaller individual contributions.

Investing through crowdfunding allows investors to access properties that may otherwise be out of their budget. It also provides the benefit of diversification, as investors can contribute to multiple projects in different locations and property types. However, it’s essential to conduct thorough research on the platform and the developers behind the projects to ensure the reliability of the investment.

Partnerships with Developers

Another way to invest in Build-to-Rent is through partnerships with property developers. In this model, an investor provides capital to help fund a BTR development project in exchange for a share of the rental income and potential profits when the property is sold. Partnerships can be highly lucrative, especially if the development is successful, but they also come with risks, as investors may have less control over the development process and outcomes.

For those who have access to significant capital, forming a partnership with a reputable developer can be a rewarding way to invest in the Build-to-Rent sector. It allows investors to benefit from large-scale developments while leveraging the expertise and experience of professional developers.

Private Equity Funds

Private equity funds provide another avenue for investors to gain exposure to the Build-to-Rent market. These funds pool capital from multiple investors to finance large-scale real estate projects, including those in the Build-to-Rent sector. Private equity funds typically focus on institutional-grade investments and may require a significant minimum investment amount.

Investing in private equity funds offers the opportunity to invest in larger, high-quality BTR projects without needing to manage the properties directly. However, these investments are typically illiquid and may involve higher fees, making them more suitable for experienced investors or those with substantial capital.

Financing Build-to-Rent Investments

Financing options for Build-to-Rent investments can vary depending on the type of investment and the scale of the project. Whether you are purchasing a single property or funding a large development, it’s essential to understand the different financing methods available.

Traditional Mortgages

If you’re planning to purchase an individual Build-to-Rent property, traditional mortgages are one of the most common financing options. A mortgage allows investors to borrow money from a lender to purchase a property, with the loan being repaid over time, typically 15 to 30 years.

For Build-to-Rent properties, lenders will assess the rental income potential of the property, along with the borrower’s creditworthiness and financial situation. Investors will need to ensure that rental income can cover mortgage payments and other associated costs, such as property management and maintenance.

Development Loans

For those investing in the construction of Build-to-Rent properties, development loans provide the necessary capital to finance the project. These loans are typically offered by banks, private lenders, or financial institutions and are structured to cover the costs of construction, permits, and other expenses related to building the property.

Development loans are often short-term and may require collateral or guarantees from the borrower. It’s important for investors to carefully evaluate the terms of the loan and ensure that the project will generate enough rental income to repay the loan upon completion.

Investment Loans and Funds

For institutional investors or those looking to invest in larger-scale Build-to-Rent projects, investment loans or funds provide the necessary capital. These financing options allow investors to pool resources with other investors, enabling them to fund large developments or acquisitions.

Investment funds, in particular, may focus on specific types of real estate investments, such as Build-to-Rent, and can provide a diversified portfolio of properties across different regions or sectors. By pooling funds, investors can access higher-value properties and benefit from economies of scale.

Tax Benefits and Considerations

Investing in Build-to-Rent properties can offer various tax benefits. These may include deductions for mortgage interest, depreciation, maintenance costs, and property management fees. Additionally, capital gains tax may apply when the property is sold, but it’s important for investors to consider the tax implications of any sale or income generated from the property.

Consulting with a tax professional or financial advisor is recommended to understand the full range of tax considerations when investing in Build-to-Rent properties, as tax laws and regulations can vary by location and property type.

Market Research and Due Diligence

Before investing in Build-to-Rent properties, conducting thorough market research and due diligence is essential. The success of your investment largely depends on choosing the right property in the right location, with the right developer, and understanding the potential risks involved.

Assessing Demand

One of the most critical steps when evaluating a potential Build-to-Rent investment is assessing rental demand in the area. Look for markets with a high percentage of renters, strong population growth, and demand for high-quality rental housing. Research local employment rates, transportation access, and nearby amenities to determine whether the location is likely to attract tenants over the long term.

Rental Yields and Location Analysis

It’s also important to assess the potential rental yield for the property, which is calculated by dividing annual rental income by the property value. Research local rental rates and trends to determine whether the expected yield meets your investment goals. Be sure to focus on areas with strong rental demand and limited supply of quality rental housing to ensure optimal returns.

Location plays a significant role in the success of Build-to-Rent investments. Proximity to transport hubs, employment centers, universities, or entertainment areas can significantly impact rental demand and property appreciation.

Developer Reputation

The success of a Build-to-Rent investment often hinges on the reputation and experience of the developer. Choose developers with a proven track record of delivering successful projects on time and within budget. Check for past projects and reviews from investors and tenants to gauge the developer’s credibility and professionalism.

Local Legislation and Regulations

Local laws and regulations related to rental housing can vary widely, and it’s important to be aware of any rent control laws, zoning regulations, and landlord-tenant laws that may impact your investment. For example, some cities or regions may have rent control measures that limit how much rent can be increased over time, which can affect rental income. Understanding these legal and regulatory factors is crucial to making informed investment decisions.

Risks of Investing in Build-to-Rent

While Build-to-Rent can be a highly lucrative investment opportunity, it’s not without its risks. Below are some potential risks that investors should be aware of:

Market Fluctuations

The real estate market can be volatile, and economic fluctuations, interest rate changes, or shifts in rental demand can impact the performance of Build-to-Rent properties. It’s important to be prepared for market fluctuations and have strategies in place to manage these risks.

Construction Delays and Cost Overruns

Construction projects, particularly large-scale BTR developments, can face delays and cost overruns. Unexpected issues such as labor shortages, supply chain disruptions, or environmental challenges can lead to delays or increased costs. Investors should carefully vet developers and ensure that proper contingency plans are in place.

Tenant Vacancy Rates

While Build-to-Rent properties tend to have lower vacancy rates than traditional buy-to-let investments, vacancies can still occur. If a property sits vacant for an extended period, it can result in lost rental income and higher operating costs. Investors should ensure they have a reliable property management company in place to minimize vacancies and tenant turnover.

Regulatory and Legal Changes

Changes in housing regulations, zoning laws, or rent control measures can have a significant impact on the profitability of Build-to-Rent investments. Keeping up to date with local regulations and working with legal advisors is crucial to navigating potential changes that could affect rental income or property value.

Management Issues

The quality of property management is a critical factor in ensuring the success of a Build-to-Rent investment. Poor property management can lead to tenant dissatisfaction, higher vacancy rates, and increased maintenance costs. Be sure to choose experienced and reliable property managers who can maintain high occupancy rates and ensure that tenants are satisfied with their living experience.

How to Maximize Returns on Build-to-Rent Investments

Maximizing returns on Build-to-Rent investments requires careful planning, strategic management, and a focus on optimizing rental income and property value. Below are some tips for maximizing returns on your BTR investments:

Effective Property Management

The key to maintaining high occupancy rates and maximizing rental income is effective property management. A well-managed property ensures that tenants are happy, maintenance issues are promptly addressed, and lease renewals are maximized. Consider hiring professional property management companies that specialize in Build-to-Rent properties to ensure smooth day-to-day operations.

Optimizing Rental Pricing

To maximize returns, it’s important to optimize rental pricing. This requires understanding the local rental market, keeping up with trends, and adjusting rent based on demand and market conditions. Research comparable properties in the area and adjust rent to remain competitive while maximizing profitability.

Value-Add Strategies

Investors can increase the value of Build-to-Rent properties through various value-add strategies, such as renovations, improvements to amenities, or even adding additional rental units. Upgrading interiors, adding energy-efficient features, or enhancing shared spaces can attract higher-paying tenants and increase rental income.

Diversification

Diversification is an effective risk management strategy. Consider diversifying your Build-to-Rent portfolio across different locations, property types, or even markets to spread risk and increase the chances of long-term success. A diversified portfolio is less vulnerable to fluctuations in any one market or location, ensuring steady returns.

Future Outlook of Build-to-Rent Investment

As the demand for rental housing continues to grow, the Build-to-Rent sector is expected to thrive. The future of Build-to-Rent investments is promising, with several trends shaping the market:

Trends in BTR Development

The rise of smart homes, sustainability, and green building standards are likely to influence future Build-to-Rent developments. Tenants are increasingly seeking energy-efficient and eco-friendly living spaces, and developers are responding by incorporating smart home technology and sustainable building practices into their BTR projects.

Impact of Demographics

Changing demographics, such as the aging population, millennials, and the growing number of single-person households, will continue to drive demand for Build-to-Rent properties. These demographic shifts are expected to lead to an increasing preference for rental living, particularly in urban areas.

Technological Advances

Technology will continue to play a significant role in the Build-to-Rent sector. From digital property management platforms to smart home features, technological innovations will enhance the rental experience for both tenants and investors. This will likely improve operational efficiency and tenant satisfaction, leading to higher returns for investors.

Conclusion

Investing in Build-to-Rent properties offers a range of advantages, from stable rental income to long-term capital appreciation. By understanding the ins and outs of this investment strategy and carefully considering your investment approach, you can position yourself for success in the growing Build-to-Rent market.

Whether you’re looking for direct ownership, passive income through REITs, or participation in large-scale developments, Build-to-Rent presents an exciting opportunity for both novice and experienced real estate investors. With the right research, financing, and management, Build-to-Rent investments can deliver steady returns while providing high-quality housing for a growing population of renters.